BASECAMP BRIEFING

Prepping Your Clients for the Climb to Homeownership

Navigating the Market Like a Mountain Trail

April 7, 2025

Imagine you're backpacking through the Sierra Nevadas: sunny skies one moment, storm clouds the next. This

week's economic news mirrored that experience, presenting a blend of optimism and uncertainty that every

Realtor® should understand clearly to guide clients effectively.

Tariff Turbulence Hits Markets

President Trump's announcement of new reciprocal tariffs has markets feeling like skiers on an unpredictable

slope—sharp turns and sudden drops. A new 10% baseline tariff on imports and additional country-specific tariffs

have ignited market uncertainty, triggering a stock selloff and flight to safety, benefiting mortgage-backed

securities.

Why Should Realtors® Care?

Tariffs could impact consumer confidence and purchasing power, potentially influencing homebuyer behavior. A

stable bond market, however, means mortgage rates might remain favorable in the short term.

Job Growth Climbs, but Watch Your Step

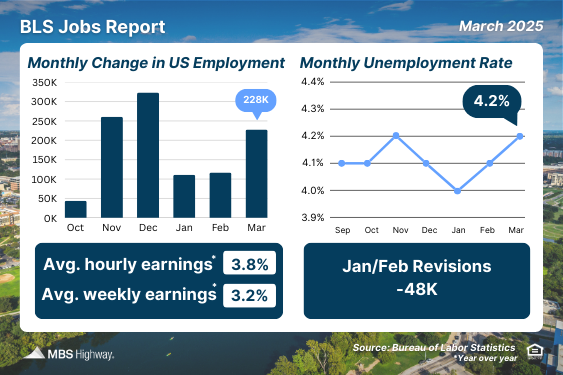

March job numbers surprised to the upside with

228,000 new jobs—far above forecasts. Yet, caution

signs abound:

- Unemployment slightly rose to 4.2%.

- Wage growth slowed, rising just 0.3% monthly.

- Prime-age workers (25-54) lost 107,000 jobs.

Private Payrolls Show Resilience

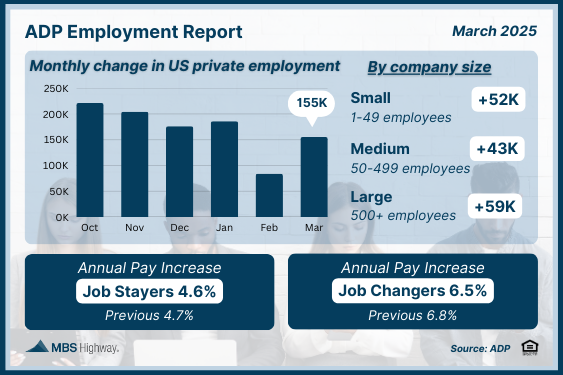

Private sector jobs jumped by 155,000, outpacing forecasts. Small businesses, previously struggling, added 52,000

positions. However, wage growth is softening, especially among job-switchers.

Why Should Realtors® Care?

Strong private-sector jobs, especially in services,

suggest sustained homebuyer interest, though

reduced wage growth indicates affordability could

remain challenging.

Why Should Realtors® Care?

Headlines may mislead buyers into overly optimistic

views. Educate clients about the mixed signals to

help manage their expectations realistically.

Sign-up

UNLOCK SAVINGS ON

YOUR MORTGAGE

We monitor your rate so you

don’t have to. Sign up today and

we’ll cover the cost of your

appraisal!

Job Openings Contract Further

February saw job openings decrease to 7.57 million, down notably in trade, finance, and hospitality. The hiring

and quit rates remain low, reflecting cautious employee behavior.

What to Watch For This Week:

- Inflation Reports: Consumer Price Index (Thursday) and Producer Price Index (Friday)

- Federal Reserve Minutes: Released Wednesday, potentially impacting market volatility

Technical Market Insights:

Mortgage Bonds rallied strongly but closed just below resistance at 100.46, while the 10-year Treasury yield

struggles to stay below 4%.

Stay informed and guide your clients like a seasoned trail guide—aware, prepared, and responsive.

Happy Trails,

Daryn Fillis

Why Should Realtors® Care?

Fewer job openings signal a cooler economy, potentially slowing buyer urgency and offering negotiating

leverage to prepared buyers.

Jobless Claims Reveal Underlying Stress

Continuing unemployment claims rose to their highest since late 2021, while announced job cuts surged 60% in

March, primarily in federal jobs.

Why Should Realtors® Care?

Increasing layoffs might eventually impact buyer demand. Monitoring employment stability in your market can

provide strategic insights for advising clients.

DARYN FILLIS

darynfillis.com

daryn.fillis@neohomeloans.com

Branch Lead | Certified Mortgage Advisor

Daryn Fillis with NEO Home Loans | Better Mortgage Corporation | NMLS# 1988371 | Branch NMLS# | Corp License# Better Mortgage Corporation NMLS #330511 | 916-647-7561 | daryn.fillis@neohomeloans.com | 1 World Trade Center, 80th Floor, New York, NY 10007 | Equal Housing Lender | Equal Housing Opportunity

916.647.7561